SALES of private property kept sizzling over the weekend as buyers, undeterred by the rainy weather and recent government policies to cool the market, packed showflats.

THE LAURELS IN CAIRNHILL ROAD – 135 out of 179 units sold, with about 40 sold over the weekend

THE VISION AT WEST COAST – 160 out of 295 units sold, including 100 during the initial preview

CORALIS NEAR MARINE PARADE – Over 50 out of 127 units taken up at its weekend preview

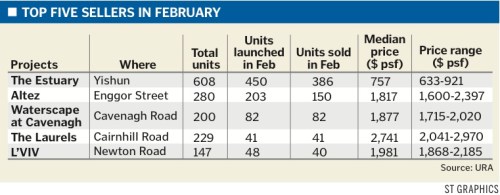

Demand was strong for mass market and prime projects, with buyers especially keen on The Laurels, an upmarket 229-unit project in Cairnhill Road.

Developer Sing Holdings has sold 135 of the 179 units so far, with around 40 – comprising mostly two-, three- and four-bedders – going over the weekend and two more taken up yesterday.

More than 90 units had already been sold at private previews for business associates and former Hillcourt Apartments owners, where the development now sits.

Prices at the project ranged from $2,800 to $3,200 per sq foot (psf).

All four penthouses have also been bought, for between $8 million and $10 million each, and the 45 one-bedroom units are also gone, a DMG & Partners report said.

‘We had a good mix of buyers with strong take-up rates across the different unit sizes. Mostly two- and three-bedroom units are left but we have no plans to release the remaining 50 units yet,’ the spokesman said.

DMG & Partners property analyst Brandon Lee said turnout for The Laurels preview was healthy, with 20 to 40 people in the showflat at any one point.

Locals made up a good proportion of the buyers, although there were some Indonesians as well, the Sing Holdings spokesman said.

Mr Lee expects 30 to 50 units to be retained for future launches so as to ride on continued rising prices within the high-end segment.

The Vision at West Coast – marketed as a high-end project in a suburban location – was also popular.

As of yesterday, 160 out of the 295 units in the Cheung Kong Holdings development had been sold, including the 100 that went during the initial preview.

This is in spite of record prices – from $1,000 to $1,200 psf – for a mass market project.

The Vision, a 99-year leasehold condominium located across the road from West Coast Park, has 281 apartments and 14 strata terrace units. It is next to Blue Horizon, where units in the resale market have gone for $764 to $841 psf this year.

UOB Kay Hian analyst Vikrant Pandey said the strong demand for The Vision served to reinforce positive views about the sustainability of the property market’s recovery, with turnout strong despite Sunday’s rain.

He expects demand to remain strong for other upcoming launches.

‘We believe the turnaround in the property segment is well supported by favourable demand-supply dynamics, high liquidity and a low interest rate environment,’ Mr Pandey added.

Tiong Aik’s Coralis near Marine Parade has also seen strong sales, with more than 50 out of its 127 units taken up at its weekend preview in Raffles Hotel. Prices were between $1,350 and $1,550 psf. It is expected to be launched this weekend.

Coralis is a freehold condominium featuring one-bedders as small as 495 sq ft and penthouses of up to 3,089 sq ft.

Mr Dennis Yong, head of special projects at HSR International Realtors – a co-marketing agent of the project – said strong demand was seen mostly from local people with the ‘perspective of home ownership’. Investors made up only about 20 per cent of buyers, he said.

Mr Yong expects continued demand in the next two to four weeks as there is still genuine demand from home buyers.

But he tips prices to continue increasing, given developers’ depleting landbanks and that new site tenders are attracting high bids.

‘Developers are not in a rush to sell. They can still push up their prices to maximise their value and to increase the average price of each unit,’ he said.

‘They are not sure how high to price their units, (so) every four to five units sold, they adjust their prices again.’

City Developments has said it plans to launch the 228-unit Residences at W Singapore Sentosa Cove this month while it hopes to release a 429-unit project in Chestnut Avenue next month. A spokesman said that while it has not launched any new projects as yet, there has been buying interest.

Local developer Hiap Hoe Group will preview its 61-unit Skyline 360 at St Thomas Walk and its 48-unit Treasure on Balmoral – a luxury development costing at least $4 million per unit – at Raffles Hotel this weekend.

CB Richard Ellis executive director of residential services Joseph Tan said he has seen ‘decent sales’ even for some of the ongoing projects such as Centennia Suites in Kim Seng Road over the past weekend.

‘Sales are still okay even for the older launches…All (projects) are moving, some are faster, some are slower but even if sales are slower, it could be the marketing strategy of the developer. Prices might still go up and with a developer having a depleting landbank, it is not in its interest to sell fast,’ he said.

Source : Straits Times – 16 Mar 2010