The first government land sale tender to close after measures were announced last Friday to cool the property market managed to draw some solid bids.

A 99-year leasehold residential site at the junction of Choa Chu Kang and Woodlands roads – which houses Ten Mile Junction – drew a top bid of $164 million or $437 per sq ft per plot ratio (psf ppr).

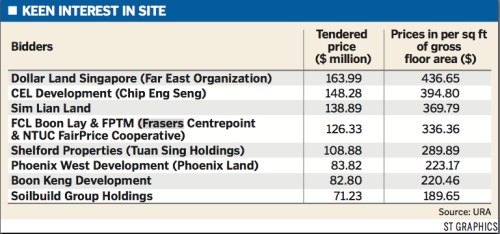

Far East Organization unit Dollar Land Singapore topped seven rivals with this bid.

Chip Eng Seng’s CEL Development put in the second-highest bid of $148.3 million or $395 psf ppr.

The top two bids are not too far from market predictions in early January, even though the government has just introduced anti-speculation measures – a seller’s stamp duty on residential property bought after Feb 19 and sold within a year, as well as a lower loan-to-value limit of 80 per cent for all private housing loans.

The response to the latest government land tender ’suggests that some developers think the measures will not have a significant impact in the longer term’, said Knight Frank chairman Tan Tiong Cheng.

Going by the tender results, Colliers International research and advisory director Tay Huey Ying said some developers are ‘realistically bullish’ and there is still confidence in the mass-market sector.

Still, consultants point out that competition for land seems to have eased from a few months back. Ms Tay noted that bids for sites in the second half of last year were usually much higher than expected.

Jones Lang LaSalle South-east Asia research head Chua Yang Liang noted that there was just a 10 per cent gap between the top and second bids this time around. The gap can be as large as 20-30 per cent when the market is hot, he said.

Other participants in the tender that closed yesterday included Sim Lian Group and a tie-up between Frasers Centrepoint and NTUC FairPrice Co-operative. The lowest bid came from Soilbuild Group, at $71.2 million or $190 psf ppr.

The 1.56-hectare site is occupied by the three-storey Ten Mile Junction. The first two levels comprise commercial space with a gross floor area (GFA) of 121,191 sq ft, while the third houses an LRT station.

The winning developer will gain control of the commercial component. It can also build a residential development with a GFA of 254,394 sq ft on top of Ten Mile Junction. The residential project could yield some 200 apartments.

Going by consultants’ estimates, the average selling price of the residential units could range from $700-$850 psf.

At the 99-year leasehold Mi Casa nearby, launched last year, three caveats were lodged for transactions at $658-$731 psf in January and February.

Source : Business Times – 24 Feb 2010