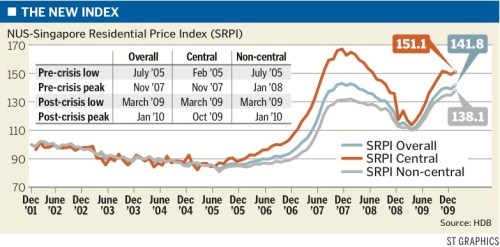

A NEW index that tracks the price of private non-landed homes month by month has been created to help owners, investors and other property watchers keep a handle on the fast-moving market.

The Singapore Residential Price Index (SRPI), as it is called, has been formulated by the National University of Singapore (NUS) after two years of research.

It functions much like the Straits Times Index for shares but instead of following certain stocks, the SRPI is based on the transacted prices of a selected basket of completed non-landed private homes.

It functions much like the Straits Times Index for shares but instead of following certain stocks, the SRPI is based on the transacted prices of a selected basket of completed non-landed private homes.

The only other index that tries to get a grip on the property market is one put out by the Urban Redevelopment Authority, but that is only published quarterly.

It is compiled based on all types of private home transactions and is intended to provide a broad indication of price trends.

The new index, which has a narrower focus, was launched yesterday by Senior Minister of State for National Develop- ment Grace Fu.

Ms Fu told the function at the Four Seasons hotel that the index can help analyse price trends and assist investors in making more informed decisions.

Associate Professor Lum Sau Kim, who led the NUS project, said formulating the index was motivated by industry interest in property derivatives.

These financial products can give investors exposure to real estate or help others manage risks in their investments.

The SRPI reflects such risks. It is based on a basket that broadly represents the target market, so landed homes, forming such a small segment, are excluded.

It also excludes projects that are more than a decade old, those that are small, rarely traded, or targeted for en bloc sale.

The basket will change every two years to reflect changes in the completed stock of private non-landed homes.

Its initial make-up comprises 74,359 units in 364 projects across 26 postal districts, completed between October 1998 and September last year.

Only completed homes are used so as to reduce the influence of new launch prices and sub-sales, which may not reflect the market. Care will also be taken to dampen the effect of one-off deals or over-the-top prices.

‘Once it is an index that people trade on, it has to be very robust to guard against manipulations,’ said Savills Singapore managing director Michael Ng.

While property derivatives may be some time away, the SRPI’s immediate benefit will be in providing reliable price data, said Mr Simon Cheong, president of the Real Estate Developers’ Association of Singapore.

Mr Cheong said it is all the more timely as the non-landed homes sector is going through ‘a particularly volatile period with shorter cycles where market watchers are eagerly looking for more transparency and greater clarity on market movements’.

Cushman & Wakefield managing director Donald Han added: ‘We’re seeing higher volumes and rapid movements in prices, so there’s a need to have a monthly coverage of property prices.

‘The SRPI will have a more accurate picture. It helps to reduce panic.’

Updated on the 28th of each month, the SRPI is on the NUS website at www.ires.nus.edu.sg/srpi_main.aspx

Source : Straits Times – 25 Mar 2010