THE flow of residential land onto the market continues with three government sites up for grabs by tender, and a fourth ready for release if developers show interest.

The three sites confirmed for tender are 99-year leasehold plots. Two are near MRT stations.

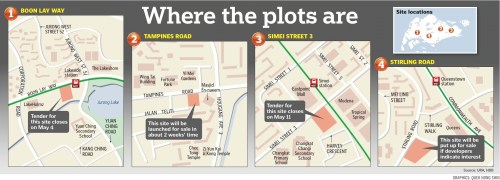

A plot at Boon Lay Way near Lakeside MRT station can yield 525 units, while a site across the road from Simei MRT station can yield about 250 flats.

A plot at Boon Lay Way near Lakeside MRT station can yield 525 units, while a site across the road from Simei MRT station can yield about 250 flats.

The third site – at Tampines Road – is on the reserve list but was triggered for sale when a developer lodged an acceptable offer of $6.5 million. It is suitable for landed homes or apartments and will be launched for tender in about two weeks.

Ngee Ann Polytechnic real estate lecturer Nicholas Mak told The Straits Times: ‘We already know these development sites will be pushed out for sale, but it is very rare that the Government would release three sites for tender and put one more available for application on the same day.’

‘It appears it wants to strongly put the point across that there is enough supply of land and residential properties for sale, to both the public and developers.’

Savills Singapore’s director of investment sales and prestige homes, Mr Steven Ming, added: ‘Developers are selling out their projects and they need to have their landbanks replenished.

‘If they are unable to do so, they will simply choose to raise the prices of their existing inventory and sell slower instead.’

Mr Mak estimates that the top bids for the Boon Lay site will range from $360 psf per plot ratio to $420. Mr Ming expects a lower price of $260 to $300 psf ppr.

DTZ’s head of South-east Asia research, Ms Chua Chor Hoon, tips bids of $330 to $390 psf ppr, considering Caspian nearby is selling for $647 to $732 psf.

The likely selling price of units on the Boon Lay Way site could be $720 to $780 psf, she said.

Experts tip the Simei site to attract bids of $320 to $410 psf ppr, translating to likely prices for flats of $750 to $850 psf.

Mr Mak reckons the Tampines site could attract bids of $335 to $390 psf ppr.

A fourth site that might hit the market is at Stirling Road. It could yield 405 units but is for sale under the reserve list system, so developers who are keen must indicate their interest by committing to a minimum bid that the Government deems acceptable.

‘If it is released for sale, the top bids could range between $500 and $550 psf ppr or $240 million to $264 million,’ said Mr Mak.

‘It will be popular with developers and home buyers because it is near the Queenstown MRT station and Anchorpoint shopping centre.’

Mr Ming is looking at possible bids of $510 to $600 psf ppr, with a final selling price of $1,100 to $1,300 psf.

The Government has sold four residential sites under the confirmed list since the start of the year. These sites were scheduled for tender without developers having to first indicate interest.

A further two private residential sites – at Sembawang Road and Upper Serangoon Road – will be up for sale via the confirmed list next month, said the Urban Redevelopment Authority (URA).

A site on the reserve list at Sengkang West Avenue was sold last month while another two sites – at Upper Changi Road North and Tampines Road – have been triggered for sale after acceptable bids were offered.

The tenders for the Boon Lay Way and Simei sites will close on May 4 and 11 respectively.

Source : Straits Times – 24 Mar 2010