Short-term trading profits in real estate are not high, while the risks are considerable. DENNIS NG shows you the numbers

IT’S tough enough figuring out which housing loan package is the best for you. But how will the latest changes in property financing rules affect your property purchase?

The recent curbs on the property market include measures such as the scrapping of interest-only loans, capping financing to 80 per cent of the property’s value, and a stamp duty on properties sold within a year of purchase.

The recent curbs on the property market include measures such as the scrapping of interest-only loans, capping financing to 80 per cent of the property’s value, and a stamp duty on properties sold within a year of purchase.

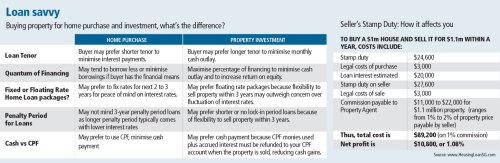

Also, are there different things to consider in financing a property that you mean to live in versus one you intend to rent out? What are the things to look out for in choosing a housing loan?

Fret not, this article will help you to decipher housing loan packages like a pro, even if you’re buying property for the first time.

Scrapping of interest-only loans

In interest-only loans, the borrower chooses not to repay any principal at all, and only services the interest cost in his monthly instalments.

Many home buyers are shocked by the idea, and unable to understand the logic of not making any principal repayment on a housing loan.

However, for a property investor, one simple way to reduce his monthly cash outlay and increase return on investment is to minimise the capital outlay on the property. Interest-only loans help by minimising the monthly cash outlay, thereby increasing the possibility of positive cashflows from the property. That is, the rental income from the property more than covers the monthly instalment. It also enables the property investor to cut his monthly debt repayment obligations, and reduce his debt-service ratio, or DSR.

Thus, Minister for National Development Mah Bow Tan announced the discontinuation of interest-only property loans in September last year to dampen speculative demand. However, this measure does not affect the average home buyer or investor since most people take housing loans that repay both principal and interest.

Property as home or investment

Is there a difference between taking a housing loan for an an owner-occupied home versus one for investment?

Yes, there is. Because a person buying a property for investment has quite different considerations from someone buying it as a home. The main differences are summarised in the table.

How banks view rental income

If a tenant pays you rent of $3,000 a month, does your monthly income go up by $3,000? Most people mistakenly think that it does. But what happens is that the bank might factor in just 50 per cent of the gross rental income as your additional income in calculating your debt-service ratio (DSR).

The all-important debt service ratio

The DSR is basically the percentage of your income used to repay your monthly debt obligations.

Here’s an illustration. Let’s say Mr A’s gross salary is $5,000. He has a car loan with a monthly instalment of $500 and a housing loan instalment of $2,000. Thus, his total monthly debt repayment obligation works out to $2,500. Divide that by his gross income and his DSR works out to 50 per cent.

In general, provided you have a prompt debt repayment record, banks would work out the maximum loan they can grant you based on a maximum DSR of 50 per cent.

Now Mr A plans to buy a second property for $1 million. He expects to rent it out for $3,500 a month. He estimates that if he takes an 80 per cent loan ($800,000) with a 30-year loan period, his monthly instalment would be $2,956.95. This is based on the current interest rate of about 2 per cent for housing loans.

However, he does not know that because there are incidental costs to a property, such as maintenance fees, insurance and other costs, banks do not take the gross rental income of $3,500 as additional income. Some banks, for the sake of prudence, might only factor in half the rental income, or $1,750. Thus, his total income works out to $5,000 plus $1,750 or $6,750.

What interest rate should one use to estimate housing loan instalments? Interest rates on housing loans fluctuate from time to time. When the economy is strong, such as in 2007, housing loan interest rates were about 4 per cent.

Thus, in calculating DSR, it might be prudent for banks and property investors to use a higher interest rate, such as 4 per cent, to calculate the cost of the loan.

Based on 4 per cent, Mr A’s monthly instalment for a loan of $800,000 works out to $3,819 (or about 30 per cent higher than using a 2 per cent interest rate.) His revised total monthly debt repayment obligation works out to $6,319, while his revised total income is $6,750.

Thus, his revised DSR stands at 93.6 per cent, which means that his loan application for a second property is likely to be rejected by the bank.

So to avoid nasty surprises, it is best to get in-principle approval for a bank loan before committing to a property.

Effect of seller’s stamp duty

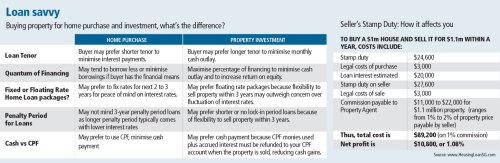

As of Feb 20, any investor who sells a property within one year of purchase will have to pay a seller’s stamp duty, which is roughly 2.5 per cent of the purchase price. This could greatly reduce the gains from selling a property within a year.

If you had bought a property for $1 million, and sold it for $1.1 million, what are your gains after deducting the cost of property purchase and sale? Refer to the table (above right) for the calculations.

The table shows that short-term trading profits in real estate are in fact not high, while the risks are considerable. If you sell your house two years later, you would not have to pay the seller’s stamp duty of $27,600 (based on the $1.1 million sale price). However, you would have to bear more interest payments for an extra year of loans.

The interest cost could come up to an extra $30,000. So if property prices rise by 10 per cent, you would not make much money at all. Of course, property agents might not volunteer such information.

To put your housing loan on a sounder footing and to get an unbiased analysis and comparison of all housing loan packages on offer, it might make sense to talk to an independent mortgage broker. After all, bank officers can only offer packages from the bank they work for.

Dennis Ng is an accountant by training with 17 years of bank lending experience.

Source : Business Times – 25 Mar 2010