CALLS for the Housing Board to revise its $8,000 household income ceiling have been getting louder as resale flat prices soar.

The most strident cries come from the ’sandwich class’ who earn too much to qualify for public housing benefits but find it hard to enter the red-hot private property market.

The most strident cries come from the ’sandwich class’ who earn too much to qualify for public housing benefits but find it hard to enter the red-hot private property market.

For a household earning not more than $8,000 a month, the benefits are significant – it can buy a new subsidised flat from the HDB, or is entitled to a housing grant of up to $40,000 to buy a unit on the resale market. Those with a monthly income of not more than $5,000 enjoy an additional grant on top of that.

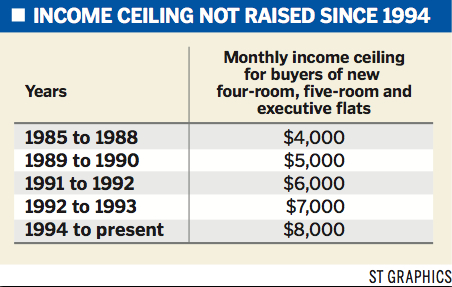

With all things being equal, there are grounds to suggest the effect of the $8,000 income ceiling is being diluted by rising income. The ceiling was last revised in 1994. Between 1995 and 2005, the proportion of resident households earning $8,000 and above every month almost doubled. This means the proportion of Singaporeans receiving housing subsidies has dropped. Continue reading