EUGENE LIM reckons the current huge base of upgraders, downgraders and PRs is likely to grow and prop up demand for resale HDB flats

THE HDB resale market has been sizzling of late. In fact, prices have hit their highest level since 1990 when the Housing & Development Board started tracking resale HDB flat prices through its quarterly resale price index.

Prices of resale HDB flats rose 3.9 per cent in Q4 2009, for an 8.2 per cent rise for the year. This took the resale index to its all-time high of 150.8 points.

Last year’s performance follows from a rise of 17.5 per cent in 2007 and 14.5 per cent in 2008. Over the last three years, resale prices have increased by some 40.2 per cent, or an average of 13.4 per cent a year.

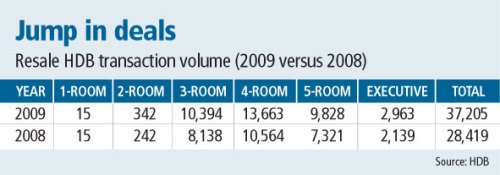

Resale volume, as shown by the number of resale applications registered quarterly, hovered around 28,000 to 29,000 units annually from 2006 to 2008.

Resale volume, as shown by the number of resale applications registered quarterly, hovered around 28,000 to 29,000 units annually from 2006 to 2008.

Last year, the total volume jumped by more than 8,000 units to 37,205 resale applications. Resale volume for 4-room flats saw the largest increase of more than 13,600 units over 2008; followed by 3-room flats with an increase of nearly 10,400 units. Five-room and Executive flats saw a smaller increase of over 9,800 and almost 3,000 units respectively.

HDB’s numbers also show that the median cash-over-valuation (COV) across all flat types was $24,000 in Q4 2009; double the $12,000 in Q3 2009; and the highest since Q2 2007 when such figures were made available. In particular, the Q4 2009 median COV of $20,500 for 3-room and $25,000 for 4-room flats have exceeded their peaks of $19,000 and $20,000 in Q3 2008 by 8 per cent and 25 per cent respectively.

Why the market is hot

Various reasons have been cited as the cause for the sizzling market in resale flats.

One view is that there are not enough HDB flats to meet demand as there are massive over-subscriptions whenever the HDB launches new flats through its build-to-order (BTO) programme.

However, it was reported in Parliament recently that while the HDB released 13,500 new flats last year and plans to release another 12,000 or more this year, in recent selection exercises, one-third of the flats were rejected on the first day of selection, when all the flats were available. So, the idea that there are not enough HDB flats to meet demand is not true.

Some have pointed to permanent residents (PRs) as the culprits who have been pushing prices up. PRs cannot buy new flats directly from the HDB and can only buy from the resale HDB market.

While PR buyers currently make up some 20-25 per cent of resale transactions, it was reported by the government that the median COV paid by PRs was the same as the nationwide median COV in the past two quarters. Cases of PRs paying high COVs are an exception, forming only 14 per cent of the 58 cases of resale transactions with COV exceeding $70,000.

A third view is that private property owners are the ones pushing up prices.

But according to the government, their numbers are not large enough to have a significant impact on prices. This group accounts for less than 20 per cent of resale transactions with COV exceeding $70,000.

While no one group can be blamed for driving up prices, they all add to the total numbers.

Resale HDB transaction volume jumped by almost 8,800 to more than 37,000 units in 2009. This is significant for any one year, especially when annual resale volume has been in the 28,000 to 29,000 range in recent years.

New policy changes

In response to calls to rein in potentially runaway prices, the HDB recently announced several policy changes. Two of them are likely to have some impact on the resale HDB market.

The first is the standardised minimum occupation period (MOP) for non-subsidised flats. This policy change is designed to curb speculation in HDB flats.

Data from HDB shows that the proportion of flat owners who sell their units within three years of purchase rose to 8.9 per cent for the first 10 months of last year. In 2008, 7.9 per cent of buyers sold their units within three years.

In comparison, less than 7 per cent of buyers sold their flats within three years between 2005 and 2007. There were concerns that some buyers were using HDB flats to speculate in the property market and driving up prices in the process.

To reduce the number of people speculating in HDB flats, the time that buyers are required to stay in their flats before reselling them – the MOP – will be increased to three years for all flats bought in the resale market without a CPF Housing Grant.

Before this change, the MOP was 2.5 years for buyers who took a HDB concessionary loan and just one year for buyers who either took a commercial bank loan or did not take any loan.

Based on ERA’s transactions last year, 50 per cent of buyers took loans from commercial banks while 10 per cent bought with cash. This means that before the policy change, 60 per cent of the buyers would be able to resell their properties after just one year.

By standardising the MOP at three years, the turnover rate is slowed down from one year to three years. This has the effect of preventing flippers from pushing up resale prices with their short-term objectives.

Next, HDB will now allow buyers to take a second concessionary loan from the agency even if they downsize or move to a flat of the same size. Previously, only upgraders qualified for a second concessionary loan.

This may actually lead to an increase in market activity due to an increase in downgraders, and it could boost resale prices for smaller flats.

However, it is still early days and we would need to continue monitoring the market.

What else can be done?

One populist view is that the rampant subletting of flats is a key factor in driving up flat prices, and the recent slew of measures to curb speculative buying and selling of HDB flats did not address this issue.

Under current rules, buyers of resale HDB flats can sublet the entire flat after three years if they did not take a government grant.

According to government numbers, of the 682,000 HDB flats that are eligible for subletting, only 3 per cent are sublet, suggesting that most flat owners are buying for occupation, and not rental.

However, the rental market indirectly influences the price of resale flats. For example, a 3-room HDB flat will yield a return of almost 7 per cent with a median rent of $1,500 a month at a median resale price of $260,000. There is no way one can achieve a 7 per cent return by investing in private residential property.

Also, the continued price rise in the private property market makes HDB flats very attractive in terms of capital outlay and yield.

Home owners, realising that they can make money from rentals, may be unlikely to sell their HDB flats even if they go on to buy private property. This leads to a drop in the number of resale flats in the market, hence driving up prices.

Also, ‘investors’ may be attracted to buy HDB resale flats to rent out immediately. Though this infringes HDB’s subletting rules, some may find a yield of 7 per cent too attractive to pass up. These buyers may already own a private home and are not in need of a HDB flat.

With such attractive returns, it is no surprise that some, if not many, may be prepared to flout the rules. Whether this group is large or small, it adds to overall demand for flats and therefore impact resale prices.

It may be an opportune time for the HDB to relook the current subletting rules that were implemented in 2007 following amendments made in 2005 and 2003 to allow HDB home owners to monetise their flats.

Before 2003, owners were not allowed to rent out their flats unless they were going overseas to work or had other valid reasons. Another way is to step up policing. Unless the current rules are enforced strictly, some people will continue to flout them.

Going forward, with the improving economy, we can expect the HDB resale market to remain buoyant for the rest of the year.

As for COVs, they are likely to stabilise as there is beginning to be some resistance to the current quantums.

With more new flats being built and priority given to first-timers, this group is shunning the resale market for obvious reasons.

However, the current base of upgraders, downgraders and PRs remain huge and is likely to grow, and they are propping up demand for resale HDB flats.

The writer is associate director, ERA Asia Pacific

Source : Business Times – 25 Mar 2010