Recent months have seen a return of buying interests to Sentosa Cove. Last week, SC Global announced that its residential project, Seven Palms Sentosa Cove sold 6 out of the 10 released units at an average selling price of S$3,300 psf. In the sub-sale and resale markets, prices of other condominium projects on Sentosa have also recovered firmly in 2H09. We think that the time is ripe for City Developments (CDL) to launch its Quayside Isle Collection project soon. While we previously assumed a bear-case scenario pricing of S$1,400 psf for the project, we are now raising our selling price estimate to S$1,900 psf. As such, our projected profit contribution from the residential component of the Quayside Isle Collection project has now been raised from S$209.7m to S$386.2m. Our fair value of CDL has now been raised to S$9.83. We maintain our HOLD rating on CDL.

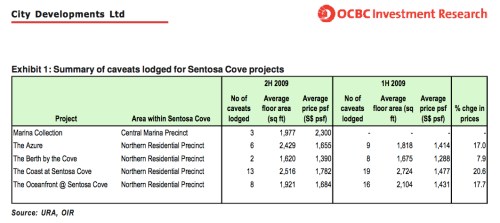

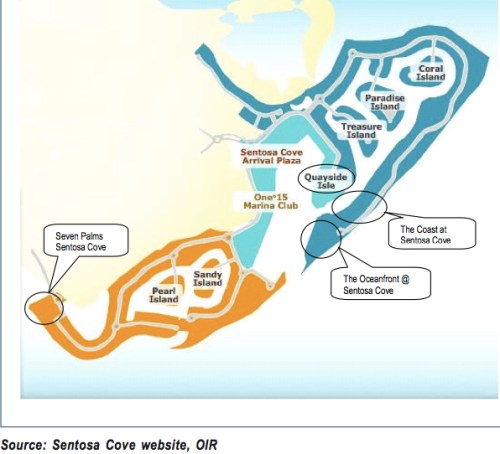

Buying interests return to Sentosa Cove. Last week, SC Global announced that its 41-unit luxurious residential project, Seven Palms Sentosa Cove, which is located at the Southern residential precinct of Sentosa Cove, sold 6 out of the 10 released units at an average selling price of S$3,300 psf. This has set a new record price for residential developments on Sentosa. In the sub-sale and resale markets, prices of other condominium projects on Sentosa have also recovered firmly in 2H09. Based on caveats lodged with URA, average prices at The Coast at Sentosa Cove and The Oceanfront @ Sentosa Cove have recovered by 20.6% and 17.7% to S$1,782 psf and S$1,684 psf respectively in 2H09 compared to prices in 1H09.

The Quayside Isle project is ripe for launch. With interests returning to the residential projects on Sentosa, we think that the time is ripe for City Developments (CDL) to launch its Quayside Isle Collection project soon. We estimate that the average unit size in the Quayside Isle Collection project to be around 1,500 sq ft to 1,600 sq ft, which is relatively smaller than the unit sizes at The Coast (~2,500 sq ft) and The Oceanfront (~2,000 sq ft). As such, we believe that the Quayside Isle Collection project could be launched at higher prices than the surrounding projects, due to the lower absolute price quantum.

Raising our selling price assumption. While we previously assumed a bear-case scenario pricing of S$1,400 psf for the project, we are now raising our selling price estimate to S$1,900 psf. As such, our projected profit contribution from the residential component of the Quayside Isle Collection project has now been raised from S$209.7m to S$386.2m. Construction for the project has already started. If the launch is this year, the project will have a significant positive impact on CDL’s FY09 earnings as CDL could book in more profits from the sales based on the advance stage of construction.

Fair value raised to S$9.83; Maintain HOLD. Our RNAV estimate for CDL has now been raised to S$9.83 (previously S$9.26), on the back of 1) higher profit assumption from the residential component of the Quayside Isle Collection project and 2) the 17% increase in the market value of Millennium & Copthorne since our last report in August. We continue to peg our fair value of CDL at par to its RNAV and thus deriving a fair value of S$9.83. We maintain our HOLD rating on CDL.

Source : OCBC Investment Research – 14 Oct 2009